|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Loan for Poor: Understanding Options and BenefitsIntroduction to Home Loans for Low-Income FamiliesObtaining a home loan can be a daunting task, especially for those with low income. However, there are several programs and strategies available to assist families in achieving their dream of homeownership. These options often provide lower interest rates, reduced down payments, and other supportive measures. Types of Home Loans AvailableGovernment-Backed LoansGovernment-backed loans such as FHA, USDA, and VA loans offer viable paths to homeownership for low-income individuals. These loans often have less stringent credit requirements and lower down payment options. Non-Profit and Community ProgramsSeveral non-profit organizations and community-based programs offer home loan assistance tailored specifically for low-income families. They focus on providing education and financial support to ensure sustainable homeownership. Advantages of Home Loans for the Poor

Things to Consider Before Applying

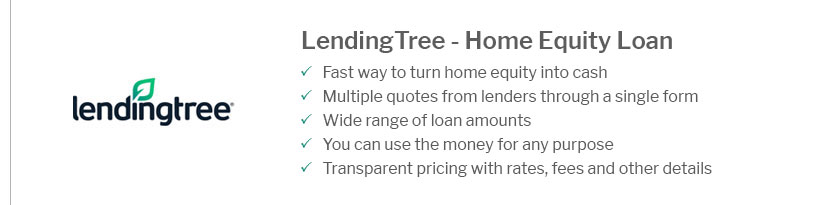

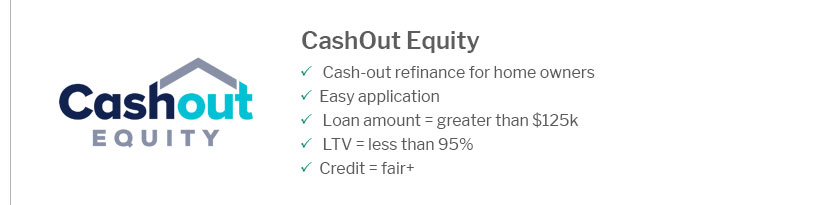

For more information on preparing for a home loan, consider visiting resources like getting a first time mortgage to better understand the process. FAQWhat is the minimum credit score required for low-income home loans?The minimum credit score varies depending on the type of loan. For FHA loans, scores can be as low as 500 with a 10% down payment, but higher scores may qualify for lower down payments. Can I refinance my home loan to reduce payments?Yes, refinancing can potentially lower your interest rate and monthly payments. It's important to compare rates, such as 10 year refinance rates, to find the best option. Are there any grants available for low-income homebuyers?Yes, various state and federal programs offer grants and down payment assistance for low-income homebuyers. These grants do not need to be repaid, making them an attractive option. https://www.usbank.com/home-loans/mortgage/first-time-home-buyers/buying-a-house-with-low-income.html

Home loan options for low-income buyers - United States Department of Agriculture (USDA) loans: For buyers with lower to moderate incomes looking for a home in ... https://themortgagereports.com/23319/7-mortgage-programs-low-minimum-credit-score

FHA loans: 500 credit score ... An FHA mortgage is a government-backed loan guaranteed by the Federal Housing Administration. This is why they're ... https://www.experian.com/blogs/ask-experian/how-to-get-a-home-loan-with-bad-credit/

The good news is that it may be possible to get a home loan even if you have bad credit. Having poor credit history can make qualifying more ...

|

|---|